- Understand and acquire the basics of employment regulations, know the compulsory formalities for taking on an employee, know how to distinguish between and draw up standard contracts.

- Master the variations in gross salary and social charges according to the different types of employment contract.

- Organise and update employee files in real time with a view to confidentiality and strict compliance with the regulations in force.

- Deepen the basics of payroll to be able to draw up an accurate payslip and regularly initiate the relevant social declarations.

- Optimise the use of a spreadsheet in accounting work, exports in EXCEL format of accounting and payroll statements.

- Getting to grips with payroll software, exploiting its functionalities and improving efficiency at the workstation;

- Identification and knowledge of the rules applicable to the company (law, collective agreements and conventions, practices and employment contracts, internal regulations, case law);

- Knowledge of compulsory recruitment formalities; Constitution of the employee's personal file; Drafting of the employment contract;Working hours and durations; Management of stoppages and terminations of salaried activity; Special type employment contracts: nature, specific features and impact on payroll processing; Calculating and accounting for grants;

- Administrative management of employment contracts; Choice of employment contracts and measurement of variances in terms of costs; Use, management, analysis of personnel files for payroll parameterisation; Periodic updates of files

- Drawing up a payslip: Legal obligations and content; Determining gross pay; Counting and remunerating working time; Compulsory social security contributions; Last pay and final balance

- Transmission of payroll data

- Use of advanced EXCEL functions; Advanced uses of WORD

- Use of PAYROLL software: Creating a payroll file in advanced mode; Identifying basic data; - Payroll slips, entries, periodic editions; closures, annual slips, backups; Historicals

Good knowledge of accounting or employees in an accounting assistant position wishing to perfect their payroll skills.

16 people

Positioning upstream of entry to training.

Interviews, remediation with the educational referent and/or company referent during training.

Taking into account the satisfaction of beneficiaries during and at the end of training.

Possibility of post-training support.

For beneficiaries with disabilities: possible adaptation of training and certification methods, support by the GRETA-CFA TH referent.

EN-certified teachers, Bac +3 trainers with significant experience in adult education, professional lecturers

Interview with a professional jury

Contact us to register for a meeting.

Returning to work as an assistant accountant or bookkeeper with this added "payroll" skill.

Access for people with disabilities

Accessible to people with disabilitiesSuccess rate: XX%

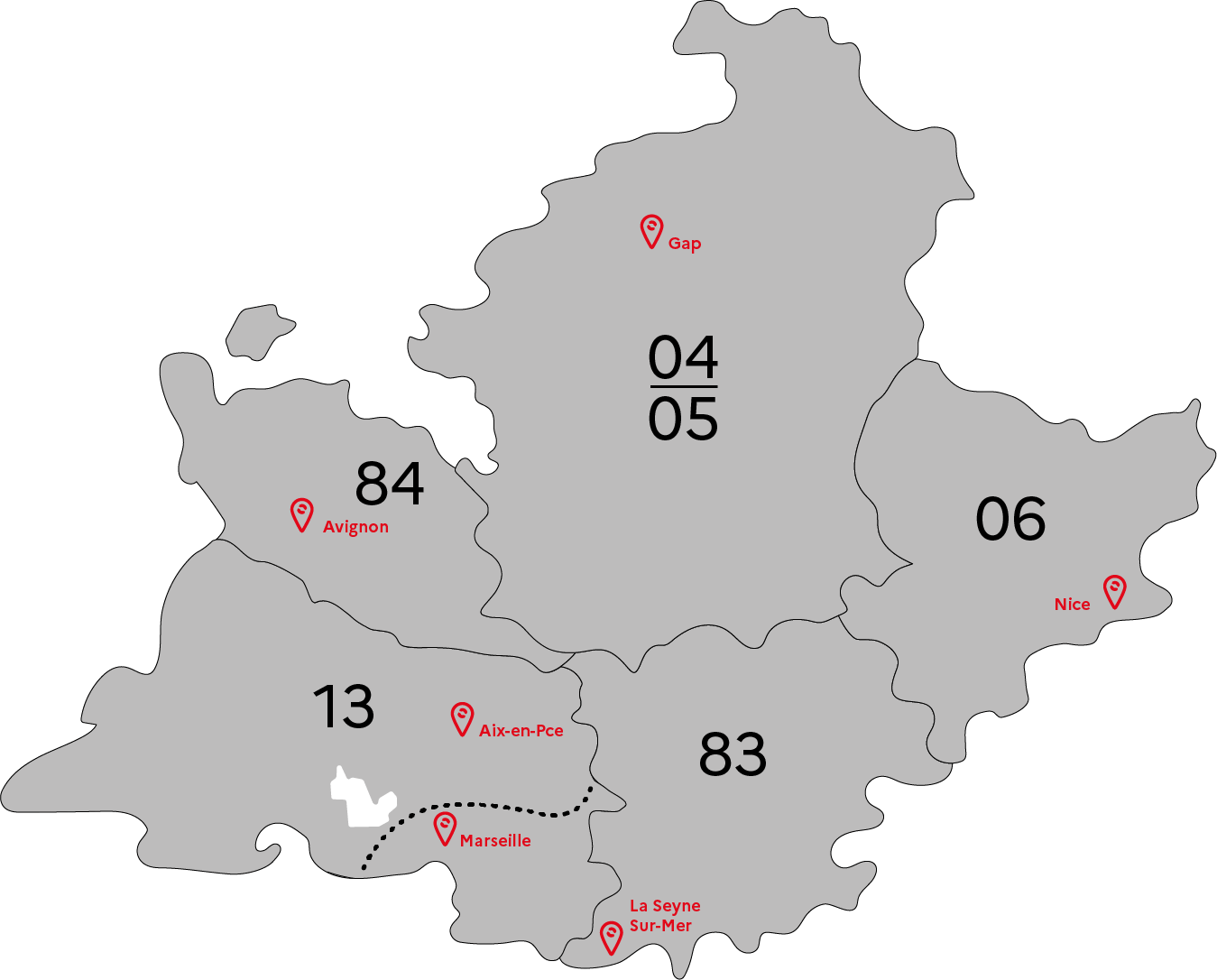

GRETA-CFA Vaucluse

GRETA-CFA Vaucluse

FORPRO-PACA

Réseau Formation Professionnelle

de l'Éducation nationale

FORPRO-PACA IS HIRING

LINKS