The accounting and tax manager draws up the various accounting and tax documents required for the company's annual or multi-year asset and management analysis.

On completion of this training course, the trainee will be able to meet all the requirements of the position:

-Typing entries, analysis forming part of internal control

- Periodic, monthly, quarterly or annual inventory work

- Presentation of periodic accounts r

- Management of company taxation (VAT, Operating taxation) taking into account complexities such as those relating to territorial conditions (new business, urban free zones, rural revitalisation zones...)

- Analysis of accounts using ratios and restatement of accounting items to highlight management elements enabling the decision-maker to define an action plan

- Carrying out all accounting and management work

- Relations with customers, suppliers, financial organisations, tax and social security authorities

- Use of software specific to his/her activity and, more generally, office automation tools (spreadsheets, means of communication and digital transfer)

BC 01 - Certificate of competence - Drawing up and presenting periodic and annual accounting statements

Determining inventory transactions for closing the accounts

Reviewing and validating annual accounts

BC 02 - Certificate of competence - Drawing up and checking tax returns

Drawing up, checking and validating periodic tax returns

Drawing up, checking and validating annual tax returns

BC 03 - Certificate of professional competence - Drawing up and presenting business activity forecasts

Analysing summary accounting statements

Drawing up and presenting budgets and financial forecasts

Find out more about this qualification (RNCP37949, exact wording of the diploma, name of the certifier, registration date of the qualification) by clicking here.

Level IV (baccalauréat or Min du travail professional qualification) in accounting

or Level Bac+1 with proven writing skills, with a good ability to analyse administrative or legal texts.

10 people

Positioning upstream of entry to the training course.

Interviews, remediation with the educational referent and/or company referent during the course.

Taking account of beneficiary satisfaction during and at the end of the training course.

For beneficiaries with disabilities: possible adaptation of training and certification arrangements, support by the GRETA-CFA TH referent.

Education Nationale certified teachers, Bac +3 trainers with significant experience in adult training, professional speakers.

Trainers experienced in individualising learning.

Course evaluations (ECF)

Professional portfolio

Interview with a professional jury

Possibility of validating one or more skill blocks

Present yourself with the liaison form from the prescriber (Mission locale, Pôle emploi...).

Positioning test by appointment.

Interview by appointment.

Insertion into employment in chartered accountancy firms or companies that manage their accounting and tax activities in-house.

Continuation of studies at levels 6 and 7: Diplôme de Comptabilité et Gestion (DCG) and Diplôme Supérieur de Comptabilité et Gestion (DSCG)

Access for people with disabilities

Accessible to people with disabilitiesCatering

Access to the school's self-service restaurant during school periods.Transport

Varlib- learning activities based as closely as possible on the conditions in which the profession is practised.

- a personalised pathway at the heart of a group learning system.

- validation throughout the support pathway based on and programmed according to the progress made by each individual.

- preparation for the final professional placement test thanks to numerous professional micro or macro simulations.

Success rate: NC%

Satisfaction rate: NC%

Job entry rate: NC%

GRETA - GIP FIPAN

GRETA - GIP FIPAN

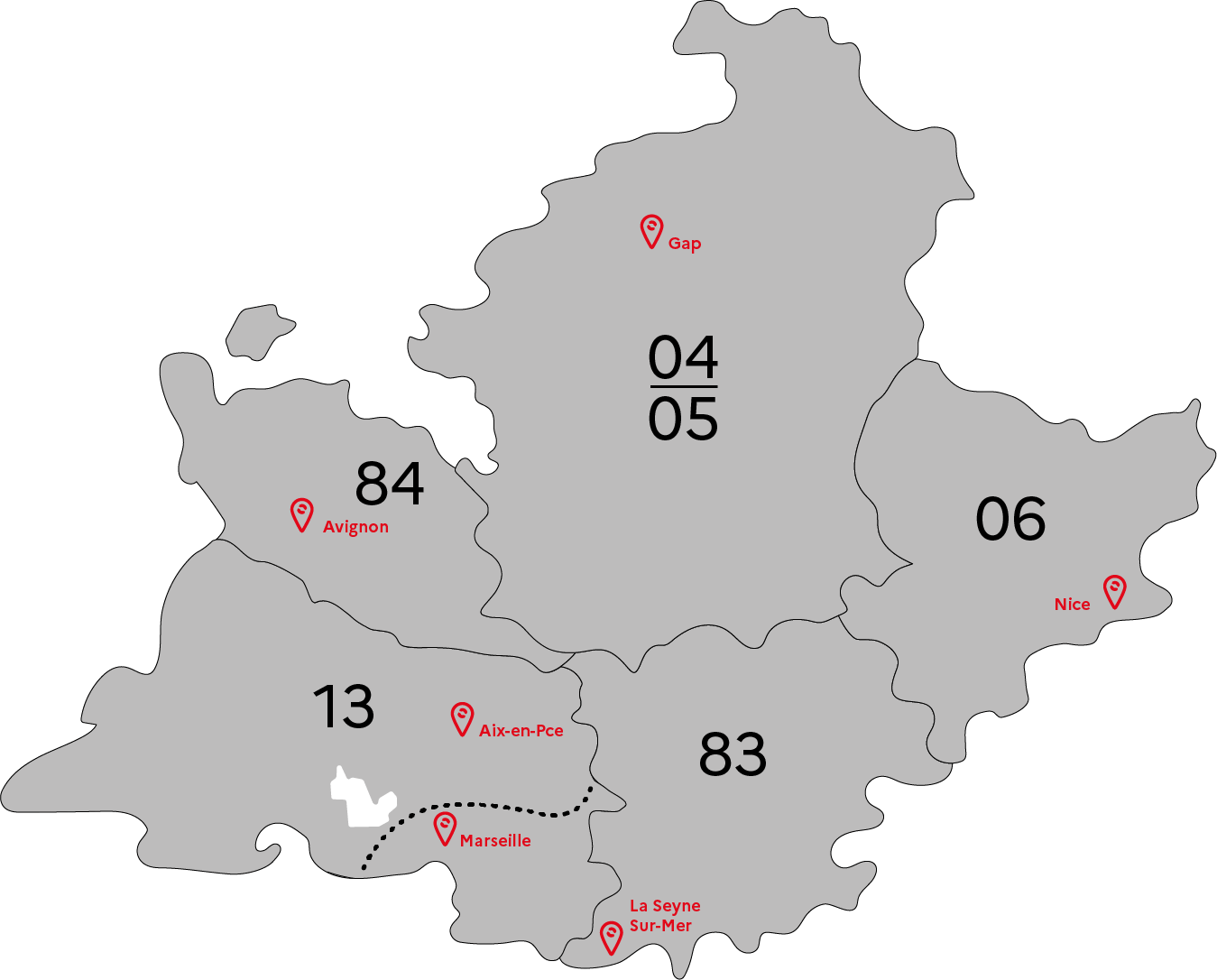

FORPRO-PACA

Réseau Formation Professionnelle

de l'Éducation nationale

FORPRO-PACA IS HIRING

LINKS