At the end of the course, the professional will be able to carry out all the basic tasks involved in the company's accounting information:

- collect, check and record all the commercial, social and tax documents needed to keep the accounts in compliance with regulations and the chart of accounts.

- check, justify and rectify the accounts for all current operations.

- collect the elements required to calculate the payroll each month, ensure that they are taken into account when drawing up pay slips and prepare the employee's administrative documents.

- draw up the VAT return and carry out the digital return, present a management chart according to the needs of the decision-maker.

- prepare the elements required to draw up the annual summary documents (income statement and balance sheet and determine the regularisations at the end of the accounting period and the annual closing operations.

- master and use a digital and dematerialised environment and use dedicated applications offered by integrated commercial and accounting management software.

- follow regulatory developments and carry out regular accounting monitoring.

Certificate of professional competence 1. Assuring day-to-day accounting operations

Certificate of professional competence 2. Preparing periodic accounting operations

Certificate of professional competence 3 - Participating in year-end accounting operations

Cross-cutting job skills

Communicating

Complying with rules and procedures

Mobilising digital environments

Knowing how to update knowledge and skills in relation to accounting regulations, social, contractual and tax regulations

Implement accounting procedures and check the conformity of accounting output

.Find out more about this qualification (RNCP37121, exact wording of the diploma, name of the certifier, registration date of the qualification) by clicking here.

Year 11, 12 or equivalent.

Has basic knowledge of accounting, is interested in business life and has a positive outlook.

16 people

Positioning prior to entry into training.

Interviews, remediation with the educational referent and/or company referent during training.

Taking into account beneficiary satisfaction during and at the end of training.

For beneficiaries with disabilities: possible adaptation of training and certification methods, support by the TH referent.

In order to improve the quality of our service, you can send us your suggestions or complaints using the form available on our website.

Education Nationale certified teachers, Bac +3 trainers with significant experience in adult training, professional speakers.

Trainers experienced in individualising learning.

Course evaluations (ECF)

Professional portfolio

Interview with a professional jury

Possibility of validating one or more blocks of skills

In the event of partial validation of the certification, the period of validity of the modules obtained is : 5 years

Positioning test by appointment.

Interview by appointment.

Training is available between 15 and 45 days before the start of the course, depending on the funding body. Please contact us.

Please send your CV to sandrine.ruiz1@ac-nice.fr

To perform the following duties in small and medium-sized companies and public accounting firms:

In a small company, the sole accountant is in charge of all work under the authority of the head of the company and usually the supervision of a chartered accountancy firm.

Continue your studies on a BTS Accounting Management or BUT in accounting and/or business management and administration specialisms.Access for people with disabilities

Accessible to people with disabilitiesCatering

School catering - Snacks in the vicinityTransport

Bus and Train- learning activities based as closely as possible on the conditions in which the profession is practised.

- a personalised pathway at the heart of a group learning system.

- validation throughout the support pathway based on and programmed according to the progress made by each individual.

- preparation for the final professional placement test thanks to numerous professional micro or macro simulations.

1st training session, we do not have Quality indicators.

Overall job integration rate: 63%

Satisfaction rate: 98%

Success rate: 92%

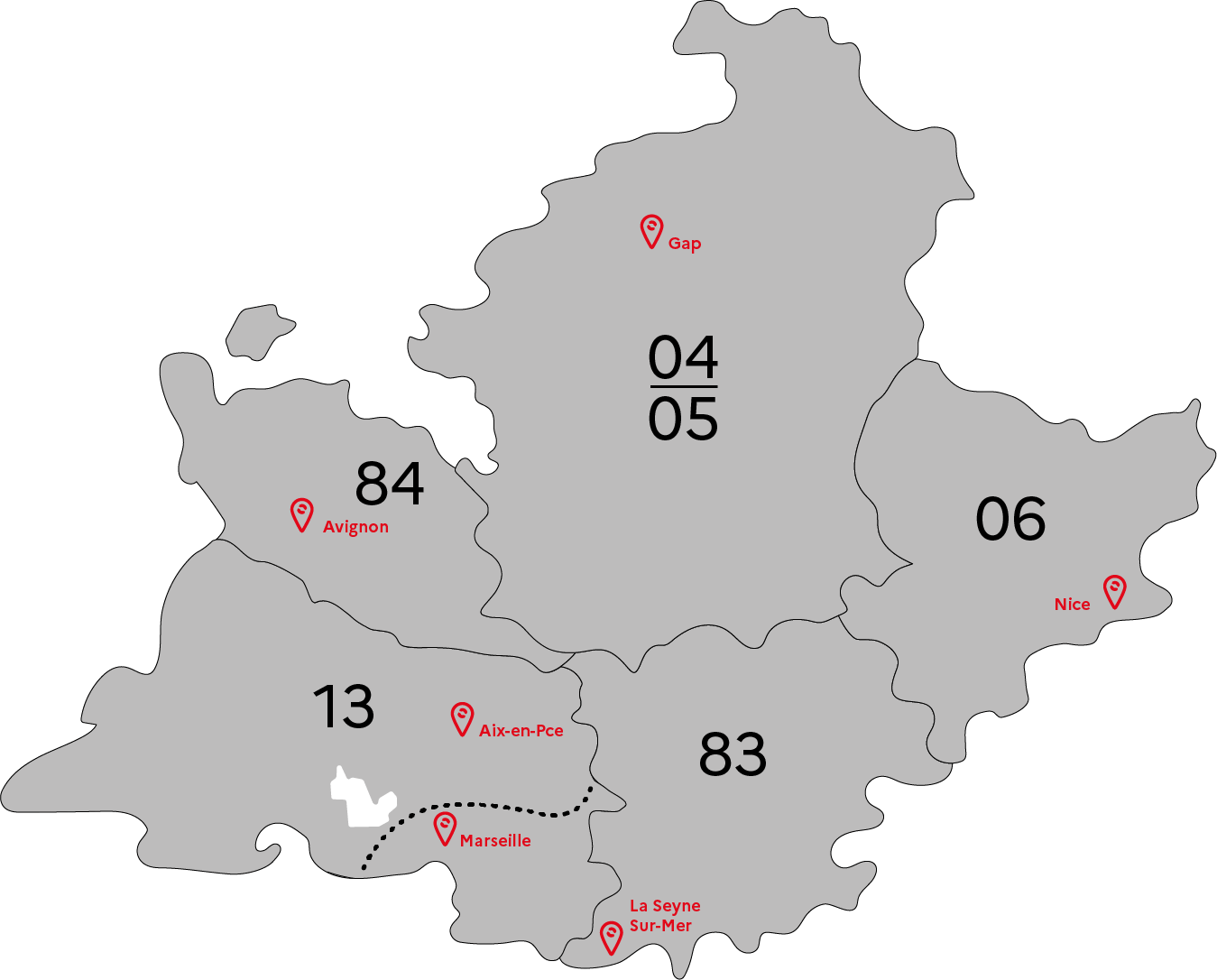

GRETA-CFA Côte d'Azur

GRETA-CFA Côte d'Azur

FORPRO-PACA

Réseau Formation Professionnelle

de l'Éducation nationale

FORPRO-PACA IS HIRING

LINKS