At the end of the course, the trained professional will be able to:

- ensure the legal processing of social information as well as payroll processing for the company or for various clients at a service provider

- take care of all mandatory social declarations relating to staff payroll.

- initiate payroll operations, draw up and check pay slips on payroll software:SAGE/CIEL, CEGID/QUADRATUS or EBP

- maintaining relations with staff, informing and/or advising them in particular on administrative management activities and procedures: recruitment, absences, leave, retirement...

- draw up management charts relating to payroll management and monitoring.

- supervise and control the work for which he/she is responsible.

Module 1 - The fundamentals of payslips: job-related pay, bonuses, allowances and salary accessories, employee savings after the Macron law, benefits in kind, business expenses, company expenses, social or cultural benefits, luncheon vouchers.

Module 2 - Handling events : SS daily allowances, Statutory and contractual salary compensation in the event of illness, salary maintenance, pay for employees on sick leave due to accidents at work and occupational illnesses, partial activity, compensation, impact on paid holidays, public holidays, redundancy pay and retirement, unpaid absences, management of the solidarity day.

Module 3 - Calculation of paid leave: acquisition, taking and deduction - reminders - in-depth: rules for paternity leave, leave for family events, paid leave allowance, additional leave days.

Module 4 - Knowing and using recruitment aids: identifying aids linked to the structure's status, monitoring regulatory sites, apprenticeship contracts, professionalisation contracts, aid for hiring the 1st employee, AFPR, POEI,

Module 5 - Pay slip for specific employment contracts: exemption principles, exemption or reduction zones, decrease in Family Allowance contributions, Fillon reduction, advance payments, advances, loans,

Module 6 - Knowing and applying miscellaneous deductions: principles of exemptions, zones of exemptions or reductions, decrease in Family Allowance contributions, Fillon reduction, advance payments, advances and loans, oppositions,

Module 7 - Carrying out a balance of accounts: redundancy, resignation, contractual termination, departure or retirement, social security and tax treatment of termination payments,

Module 8 - Practising accounting on accounting software : SAGE-CIEL, CEGID-QUADRATUS or EBP, payroll regulations, creation and configuration of an employee file, recovery of accumulations, contribution base, recovery of paid leave, entry and management of absences, entry and management of events and exits, entry and editing of BS, editing of the payroll journal, links with social organisations, period closures of salaries, management of advance payments and transfers

Basic knowledge and practice of payroll

Good written and oral communication in French: spelling and syntax.

Practical use of accounting or payroll management software or, failing that, good knowledge of EXCEL

12 people

Positioning upstream of training entry.

Interviews, remediation with the educational referent and/or company referent during training.

Taking account of beneficiary satisfaction during and at the end of training.

Possibility of post-training support.

For beneficiaries with disabilities: possible adaptation of training and certification methods, support by the TH referent.

In order to improve the quality of our service, you can send us your suggestions or complaints using the form available on our website.

Trainers experienced in individualised learning.

In-course evaluations (ICE)

.Positioning test by appointment.

Interview by appointment.

Integration into employment as an assistant payroll manager, HR payroll assistant, manager of a very small business

Access for people with disabilities

Accessible to people with disabilitiesNew training course in Miramas

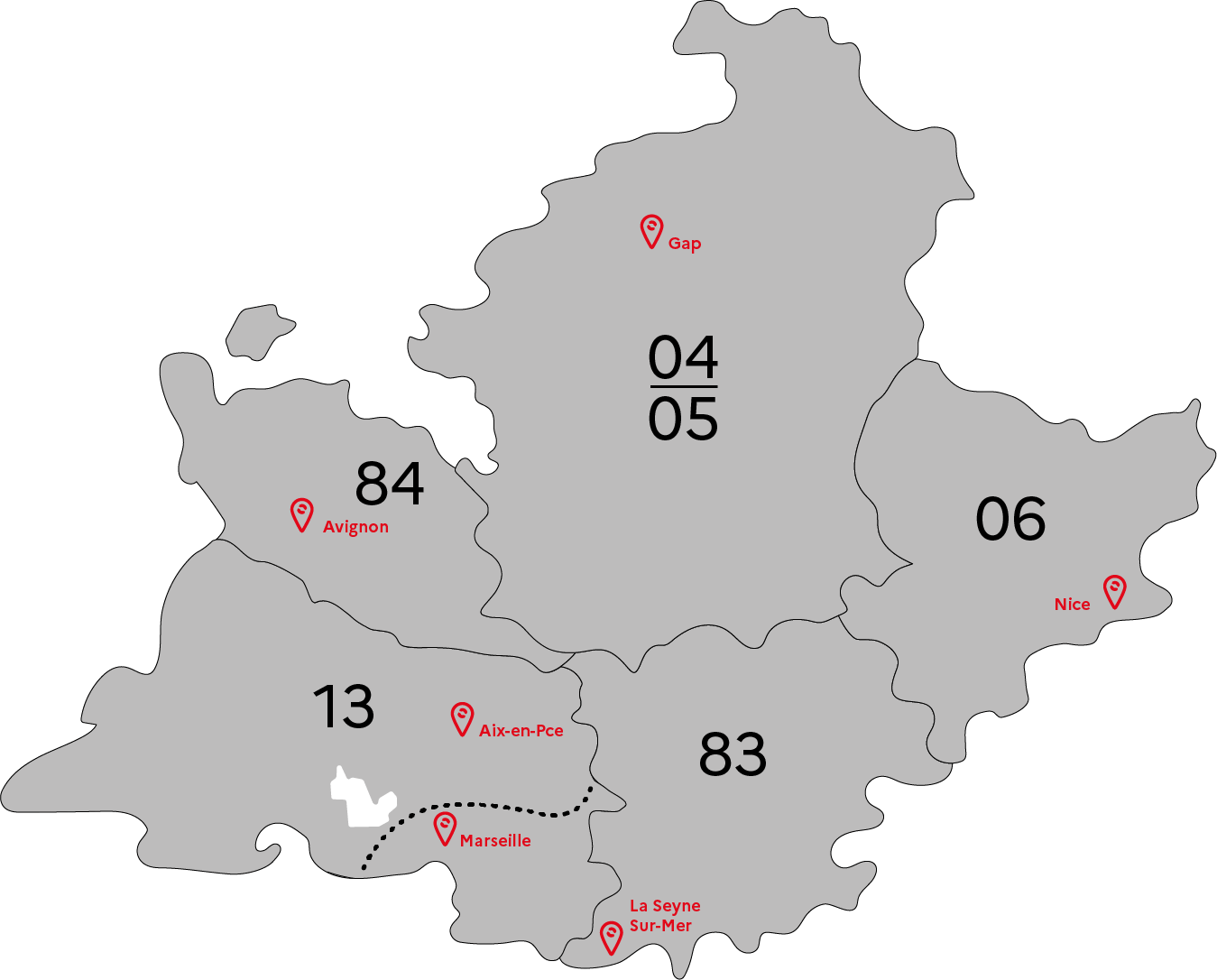

GRETA-CFA Provence

GRETA-CFA Provence

FORPRO-PACA

Réseau Formation Professionnelle

de l'Éducation nationale

FORPRO-PACA IS HIRING

LINKS