Acquire sufficient mastery of the tools and functionalities of the accounting and payroll software required :

- to set up your software properly and adapt it to your needs

- to discover the advanced functions of the software (keeping analytical accounts, managing multiple deadlines, etc...)

- to master the day-to-day work of keeping accounts (data entry, lettering, etc...)

- to learn how to manage your accounts receivable properly (payment schedule, reminders, etc....) and monitor cash flow (cash flow forecasts)

- learn how to administer the company's staff (employee file, entries, exits, holiday planning)

- learn how to draw up a payslip incorporating variable elements

- manage social and administrative declarations

- join the accounts department of a company or firm, or aim for a skills upgrade in the position held.

At the end of the course, an operational level is expected on one of the following software packages: CIEL/SAGE, QUADRATUS or EBPIntegration period: welcome, introduction of candidates, tour de table, individual expectations, training objectives, time and role as a learner, positioning, types of activities, expected participation, administrative procedures, resources (equipment, HR, each person's career path), presentation of the ENT and/or LMS platform.

Module 1 - Creating the file: setting up the accounting file, application ergonomics, setting up the accounts (journals, chart of accounts, bank), entry modes (entry by journal, entry by guide, practical entries)

Module 2 - Accounting processing: consultations and lettering, VAT declaration on debits, creating a fixed asset, generating a fixed asset entry closing operations, editing summary documents (general ledger, journal, balance sheet, preparatory balance sheet)

Module 3 - Analytical and budgetary accounting: creating and using analytical items and grids, creating and using budgets, printing and managing results.

Module 4 - Cash management: entry of entries, management of payment schedules (customers and suppliers), bank reconciliation (consultation, validation), printing.

Module 5 - Collections/Disbursements: entry of customer collections, deposit of pending securities, generation of LCR or direct debit files, entry of supplier payments, generation of a transfer file, chequebook management.

Module 6 -Slip management: preparation of pay slips, management of pay variables (individual and batch), pay slip management, regularisation operations, reverse calculation of a pay slip, history of pay slips, periodic management, closing of pay slips, monthly, annual, management of social security declarations, creating and filing your Monthly DSN, creating and filing a DSN report (end of contract, sick leave, etc...

Module 7 -Staff management: Leaving an employee, leaving date / payslip / STG, attestation set-up and printing, payslips, journal, payroll book, payroll statement. Backup.

Module 8 - Withholding tax: setting up the withholding tax in the software. Recovery of withholding tax rates.

Knowledge and practice of accounting and payroll.

Good written and oral communication in French: spelling and syntax.

Practical use of accounting management software or, failing that, good knowledge of EXCEL

.12 people

Positioning prior to entry to the course.

Interviews, remediation with the educational referent and/or company referent during the course.

Trainers with 3 years' higher education and significant experience in adult education, professional lecturers.

Trainers experienced in the individualisation of learning.

Evaluations at the end of the course

Positioning test by appointment.

Interview by appointment.

Join the accounting department of a company or firm, or aim to develop your skills in the position you hold.

Access for people with disabilities

Accessible to people with disabilitiesLearning situations built around professional assignments and simulations.

2022

STATUSFACTION RATES 100%

RECOMMENDATION RATES 56%

SUCCESS RATES 100%

INSERTION RATES 50%

2021

STATUSFACTION RATES 100%

RECOMMENDATION RATES 57%

SUCCESS RATES 100%

INSERTION RATES 50%

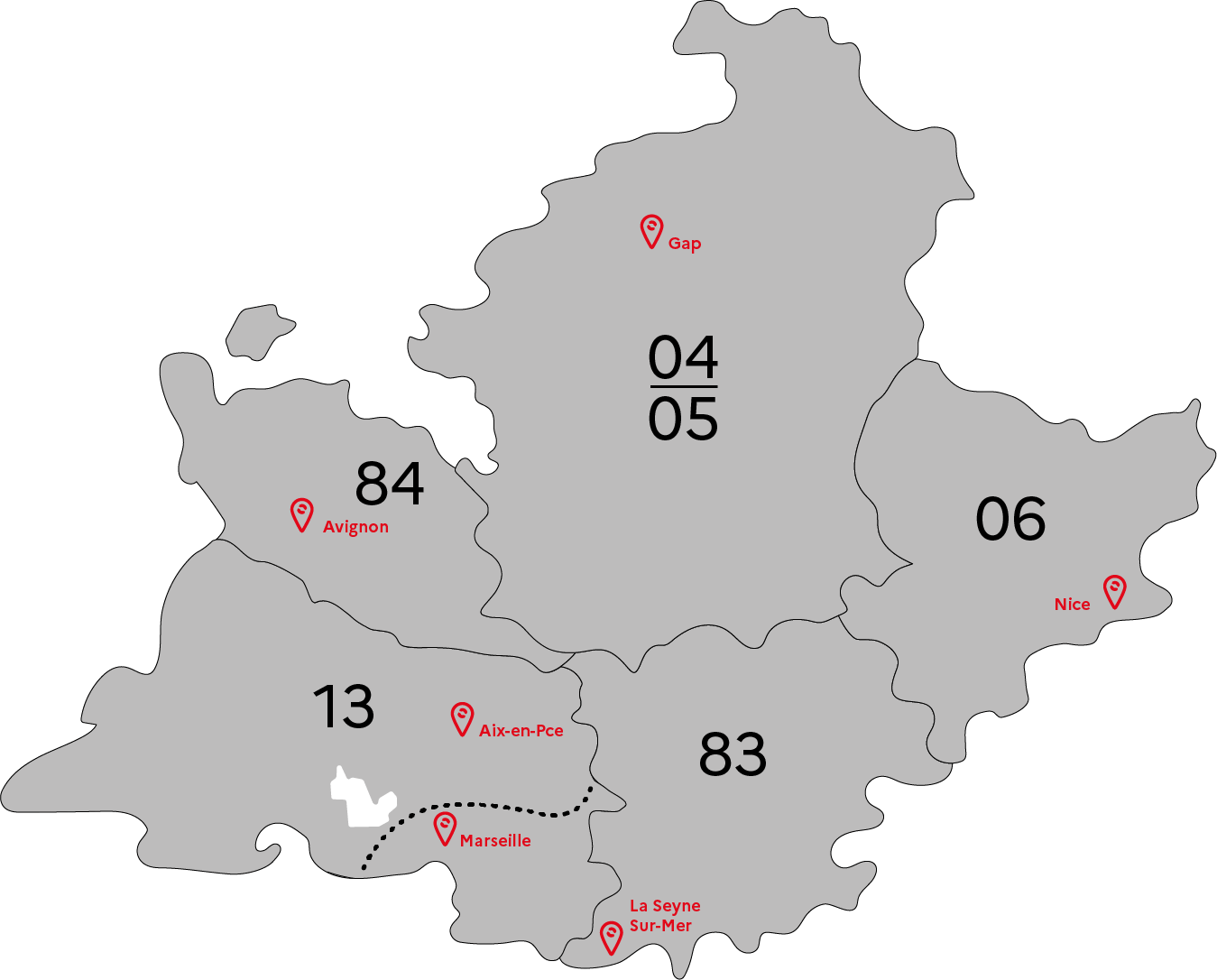

GRETA-CFA Provence

GRETA-CFA Provence

FORPRO-PACA

Réseau Formation Professionnelle

de l'Éducation nationale

FORPRO-PACA IS HIRING

LINKS