Acquire the tax and accounting knowledge needed for year-end work and improve your skills in analysing, processing and controlling this work

Purchases and disposals of fixed assets - 7 hours: Acquisition of fixed assets; Breakdownable assets

Depreciation - 28 hours: Linear and diminishing balance depreciation; Technical or economic depreciation; Accounting records; Depreciation and fixed asset tables

Sales of fixed assets - 7 hours: Asset disposals; Results of disposals

Miscellaneous depreciation, provisions and accruals - 42 hours: Depreciation of fixed assets, accounts receivable, inventories and securities; Provisions in management accounts; Other accruals

The formation of the balance sheet and income statement - 14 hours: Changes in inventories; Income statement and balance sheet

Mastering the general accounting module: analysing and recording routine transactions during the financial year and the main year-end transactions

8 people

Positioning upstream of entry to training.

Interviews, remediation with the educational referent and/or company referent during training.

Taking into account the satisfaction of beneficiaries during and at the end of training.

Possibility of post-training support.

For beneficiaries with disabilities: possible adaptation of training and certification methods, support by the GRETA-CFA TH referent.

EN-certified teachers, Bac +3 trainers with significant experience in adult education, professional lecturers

Interview with a professional jury

Contact us to register for a meeting.

Access for people with disabilities

Accessible to people with disabilitiesSuccess rate: XX%

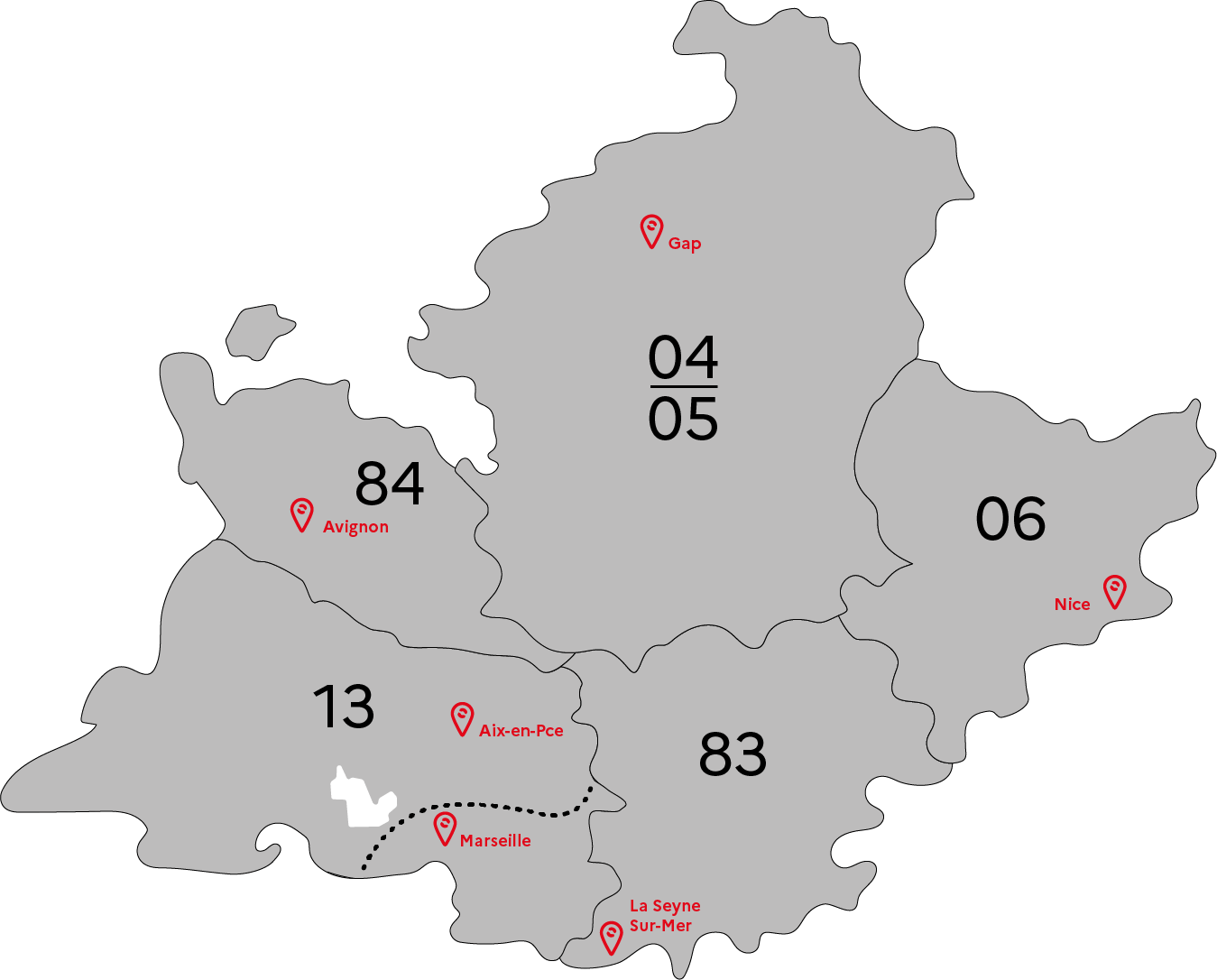

GRETA-CFA Vaucluse

GRETA-CFA Vaucluse

FORPRO-PACA

Réseau Formation Professionnelle

de l'Éducation nationale

FORPRO-PACA IS HIRING

LINKS