Be able to record inventory transactions, process VAT on receipts, transactions with foreign countries (EU, non-EU), analyse summary documents and draw up forecasts

1. Common accounting entries: purchases; sales; cash

2. Value added tax: on debits; on receipts; foreign transactions

3. Fixed assets: purchase; disposal

4. Periodic controls: lettering and adjustment of third-party accounts; bank reconciliation statements

5. Financial choices and budgets

6. Summary documents: balance sheet; income statement; appendices

>.Knowing the basic principles of general accounting, knowing how to record routine accounting entries for purchases, sales and cash flow.

Be able to carry out checks on third-party and cash accounts.

12 people

Positioning upstream of entry to training.

Interviews, remediation with the educational referent and/or company referent during training.

Taking into account the satisfaction of beneficiaries during and at the end of training.

Possibility of post-training support.

For beneficiaries with disabilities: possible adaptation of training and certification methods, support by the GRETA-CFA TH referent.

EN-certified teachers, Bac +3 trainers with significant experience in adult education, professional lecturers

Tests at the end of the course (One-off assessment)

Interview with a professional jury

Access for people with disabilities

Accessible to people with disabilitiesTransport

The entrance is on the Nationale 7, on the town centre/Carrefour shopping area axis.

- learning activities based as closely as possible on the conditions of professional practice.

- a personalised course at the heart of a group learning system.

- a precise skills certificate that will be very useful in your job search

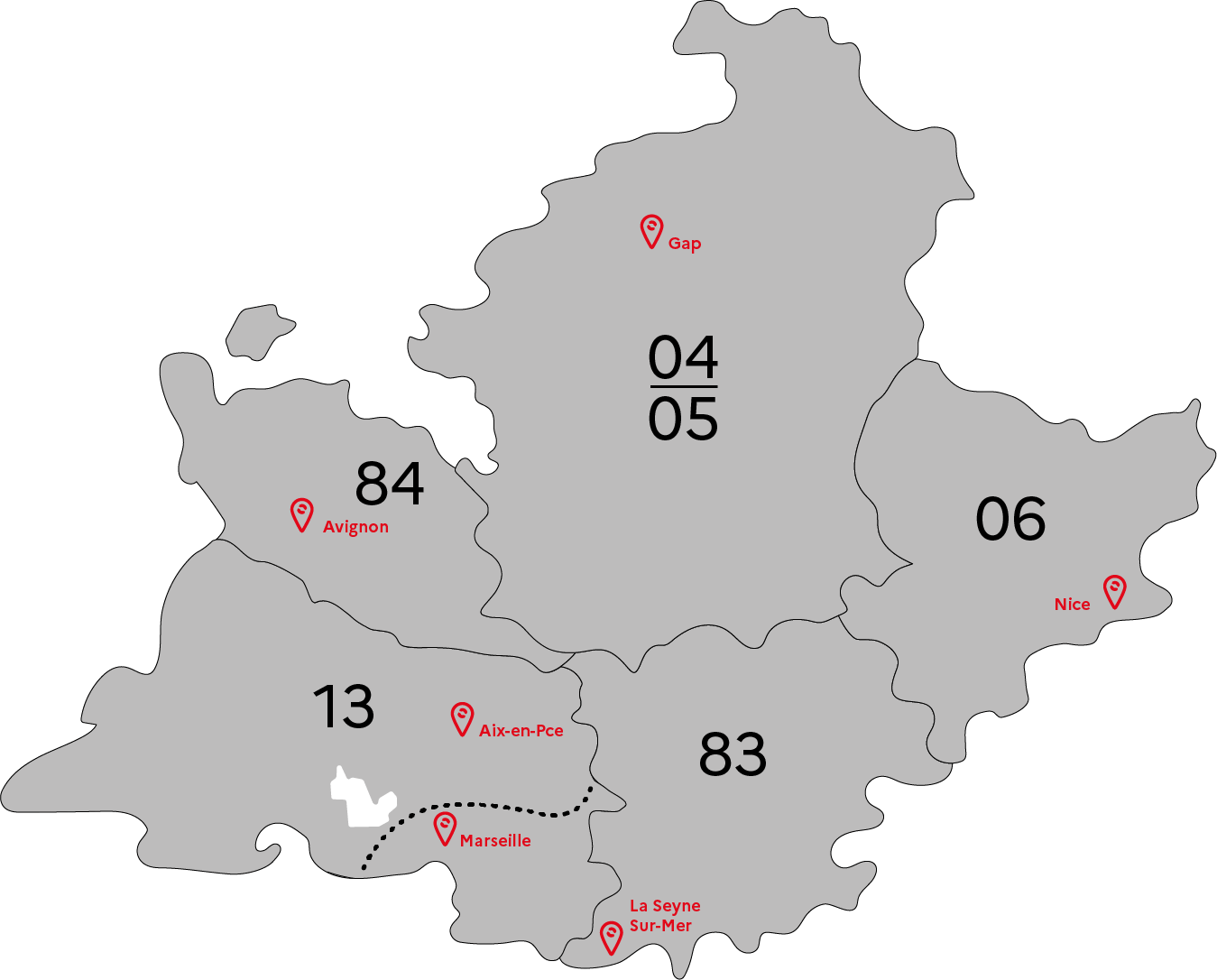

GRETA-CFA Vaucluse

GRETA-CFA Vaucluse

FORPRO-PACA

Réseau Formation Professionnelle

de l'Éducation nationale

FORPRO-PACA IS HIRING

LINKS