To review the general organisation of an accounting system. Be able to carry out routine operations relating to commercial action, cash flow and payroll, carry out checks on third-party and cash flow accounts, calculate and complete a VAT return, read and understand summary documents.

1. Reminder of basic knowledge: purchases; sales; cash flow; fixed assets

2. Accounting organisations

3. Drawing up credit notes and customer statements

4. Customer accounting

5. Supplier accounting

6. Accounting for bills of exchange

7. Cash accounting

8. Value added tax

9. Staff costs

10. Control and summary documents

Have followed the Initiation level 1 module or have a knowledge of accounting (studies or professional experience) corresponding to the knowledge acquired at this first level.

Mastery of basic knowledge (common base of knowledge) essential.

16 people

Positioning upstream of entry to training.

Interviews, remediation with the educational referent and/or company referent during training.

Taking into account the satisfaction of beneficiaries during and at the end of training.

Possibility of post-training support.

For beneficiaries with disabilities: possible adaptation of training and certification methods, support by the GRETA-CFA TH referent.

EN-certified teachers, Bac +3 trainers with significant experience in adult education, professional lecturers

Possibility of validating one or more skill blocks

Contact us to register for a meeting.

Access for people with disabilities

Accessible to people with disabilitiesTransport

The entrance is on the Nationale 7, on the town centre/Carrefour shopping area axis.

- learning activities based as closely as possible on the conditions of professional practice.

- a personalised course at the heart of a group learning system.

- a precise skills certificate that will be very useful in your job search

Success rate: XX%

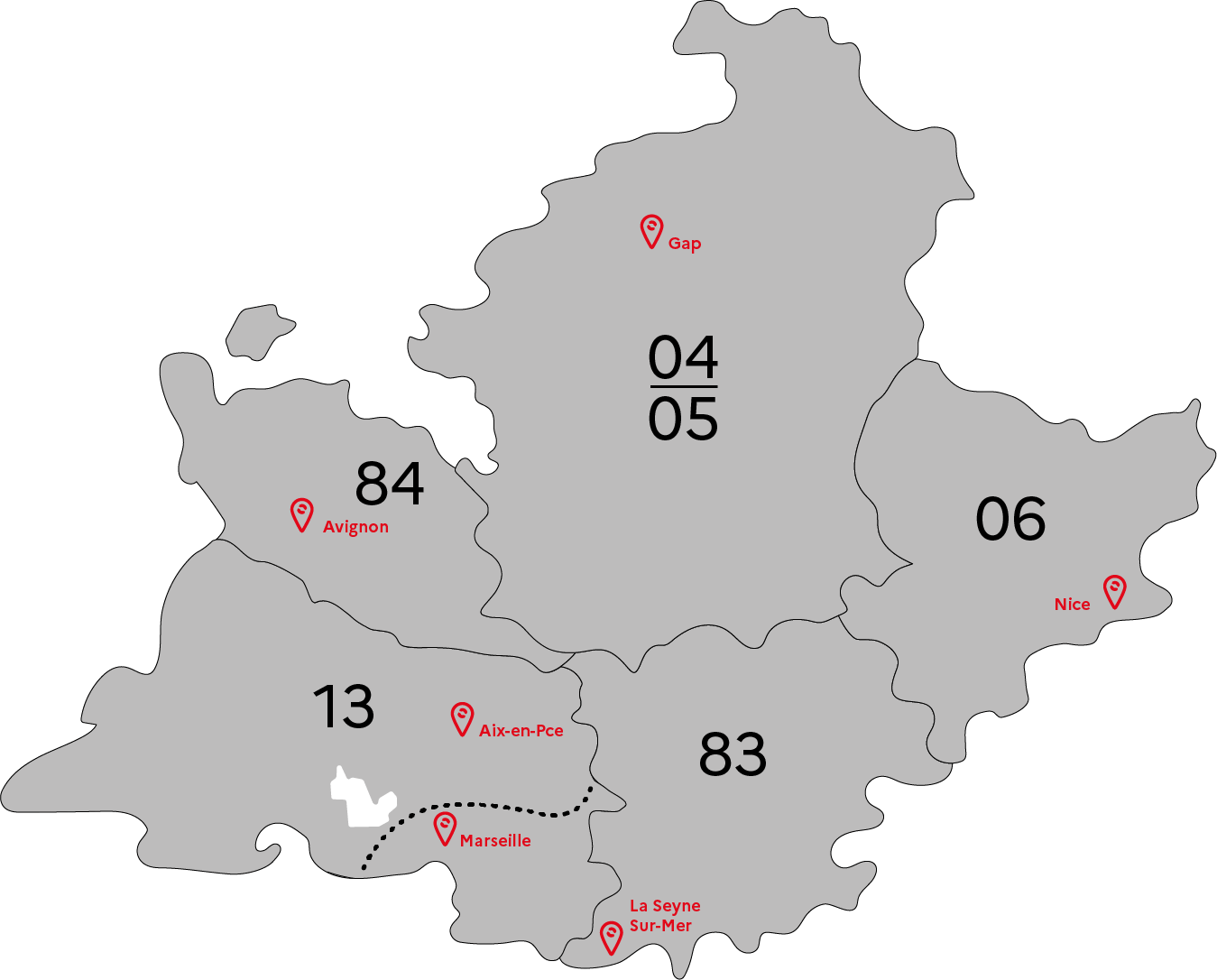

GRETA-CFA Vaucluse

GRETA-CFA Vaucluse

FORPRO-PACA

Réseau Formation Professionnelle

de l'Éducation nationale

FORPRO-PACA IS HIRING

LINKS