To review the general organisation of an accounting system. Be able to carry out routine operations relating to commercial action, cash flow and payroll, carry out checks on third-party and cash flow accounts, calculate and complete a VAT return, read and understand summary documents.

1. Reminder of basic knowledge: purchases; sales; cash flow; fixed assets

2. Accounting organisations

3. Drawing up credit notes and customer statements

4. Customer accounting

5. Supplier accounting

6. Accounting for bills of exchange

7. Cash accounting

8. Value added tax

9. Staff costs

10. Control and summary documents

Have followed the Initiation level 1 module or have a knowledge of accounting (studies or professional experience) corresponding to the knowledge acquired at this first level.

Mastery of basic knowledge (common base of knowledge) essential.

EN-certified teachers, Bac +3 trainers with significant experience in adult education, professional lecturers

Access for people with disabilities

Accessible to people with disabilitiesTransport

behind the police station

near the village hall and bowling alley

- learning activities based as closely as possible on the conditions of professional practice.

- a personalised course at the heart of a group learning system.

- a precise skills certificate that will be very useful in your job search

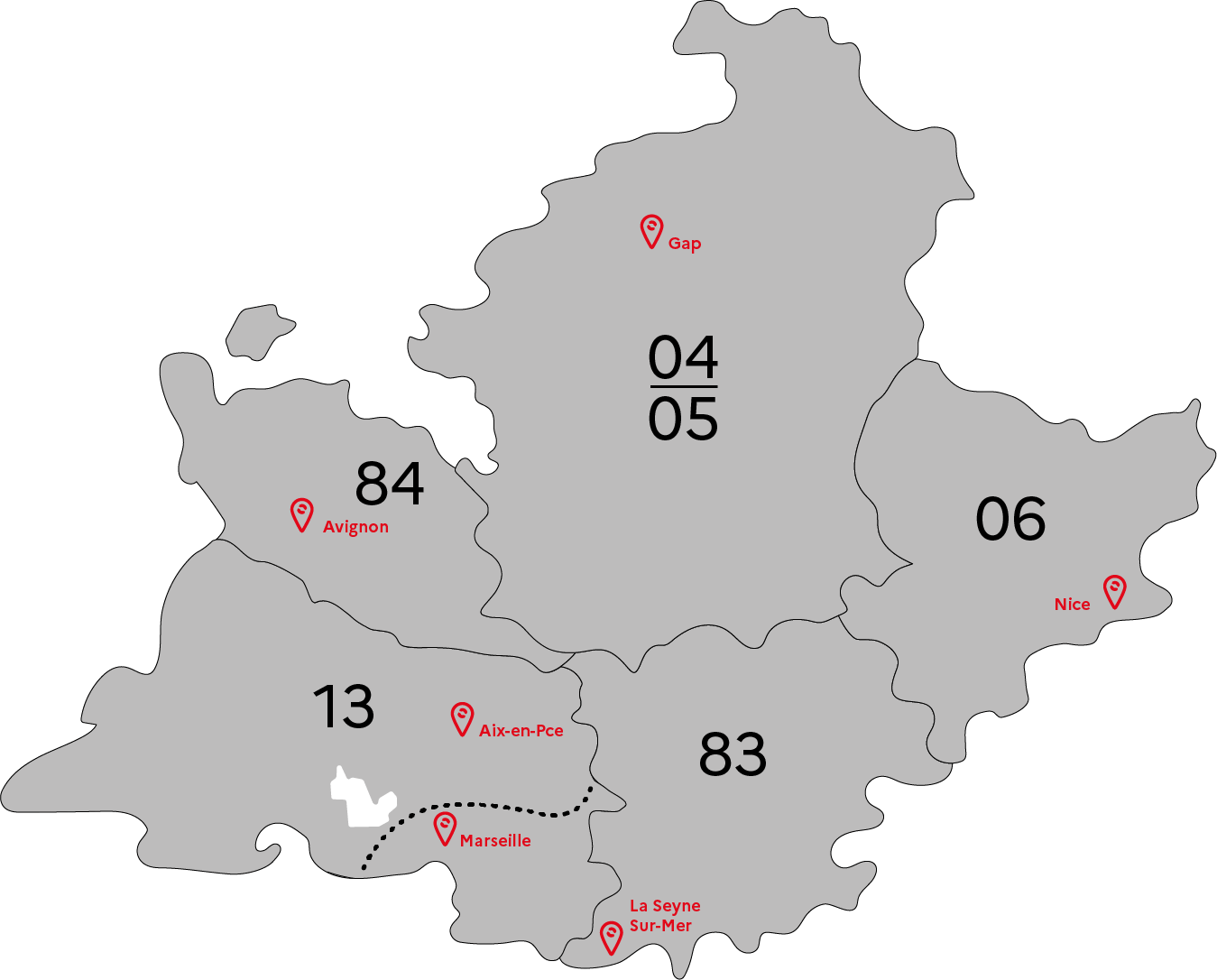

GRETA Ouest 13

GRETA Ouest 13

FORPRO-PACA

Réseau Formation Professionnelle

de l'Éducation nationale

FORPRO-PACA IS HIRING

LINKS