Understanding accounting logic

Be able to record routine purchasing, sales and cash transactions, check third-party and cash accounts, calculate and complete a VAT return, read and understand summary documents.

1. The company's accounting position

2. Monitoring the company's accounts

3. The company's chart of accounts

4. The accounting organisation

5. Customer invoices

6. The accounting entry of sales invoices

7. The receipt of supplier invoices

8. The accounting entry of purchase invoices

9. VAT

10. Recording cash transactions

11. Controlling accounts:Lettering of third-party accounts; The bank reconciliation statement

BEPC level; basic knowledge essential

.Trainers experienced in individualised learning.

Access for people with disabilities

Accessible to people with disabilities- learning activities based as closely as possible on the conditions of professional practice.

- a personalised course at the heart of a group learning system.

- a precise skills certificate that will be very useful in your job search

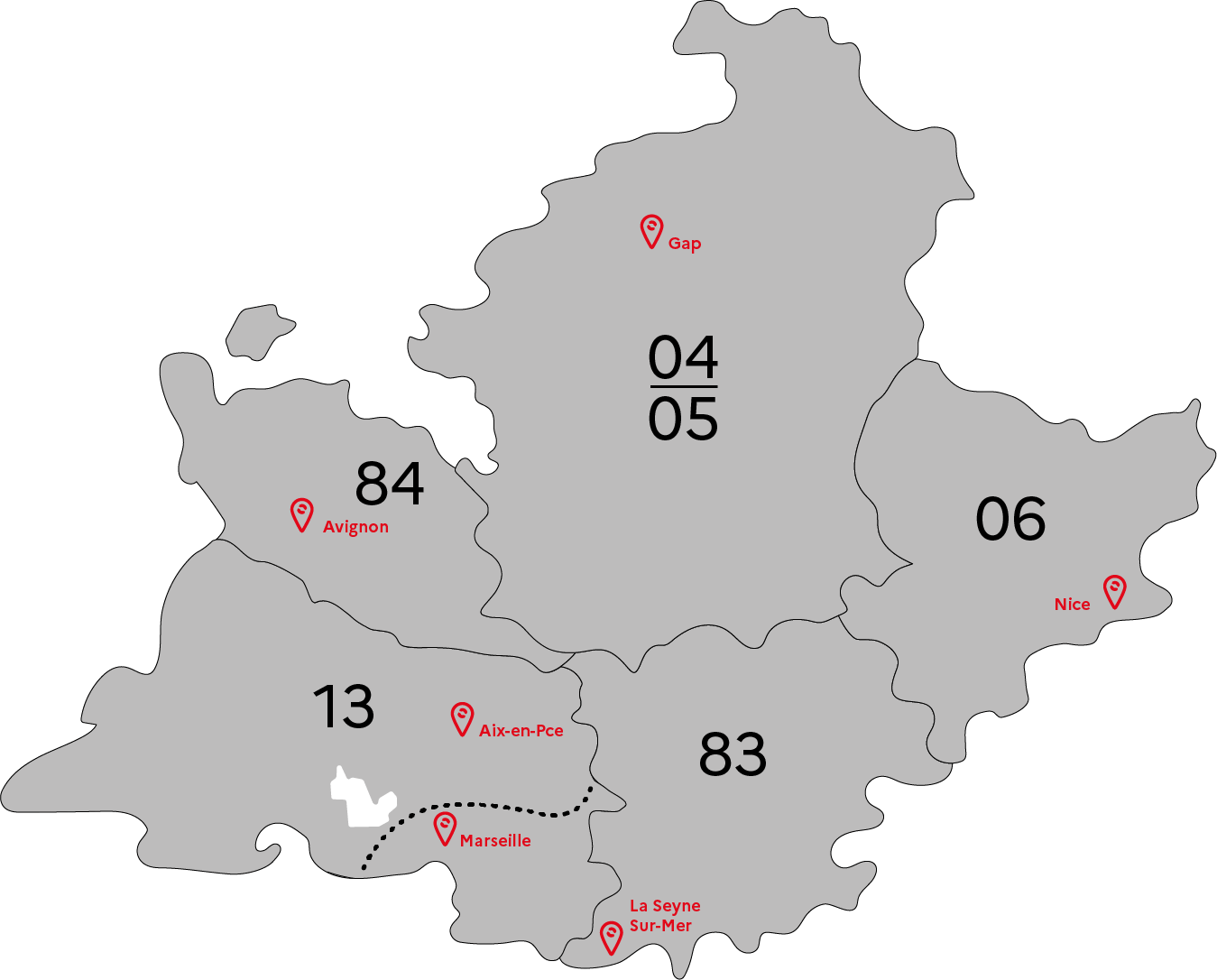

GRETA-CFA Vaucluse

GRETA-CFA Vaucluse

FORPRO-PACA

Réseau Formation Professionnelle

de l'Éducation nationale

FORPRO-PACA IS HIRING

LINKS