Managing payroll

FIXING WAGES: the employment contract; collective agreements; company agreements

REMUNERATION AND PAYMENT OF WAGES: la monthly payment scheme; public holidays; overtime; paid leave; absences; bonuses and allowances; benefits in kind; advance payments; wage garnishments. (strict compliance with changes in legislation and regulations)

PAYROLL PROCESSING: lpreparation and calculation of pay components; preparation of pay slips; payroll bookkeeping; social security and tax declarations; calculation of employer contributions; preparation of periodic social security declarations; regularisation of charges and preparation of annual social security and tax declarations; settlement of pay and charges.

Knowing how to handle routine transactions and VAT returns

16 people

Positioning upstream of entry to training.

Interviews, remediation with the educational referent and/or the company referent during training.

Taking into account the satisfaction of beneficiaries during and at the end of training.

For beneficiaries with disabilities: possible adaptation of training and certification methods, support by the GRETA-CFA TH referent.

Possibility of post-training support.

EN-certified teachers, Bac +3 trainers with significant experience in adult education, professional lecturers

Interview with a professional jury

Contact us to register for a meeting.

Access for people with disabilities

Accessible to people with disabilitiesTransport

The entrance is on the Nationale 7, on the town centre/Carrefour shopping area axis.

Success rate: XX%

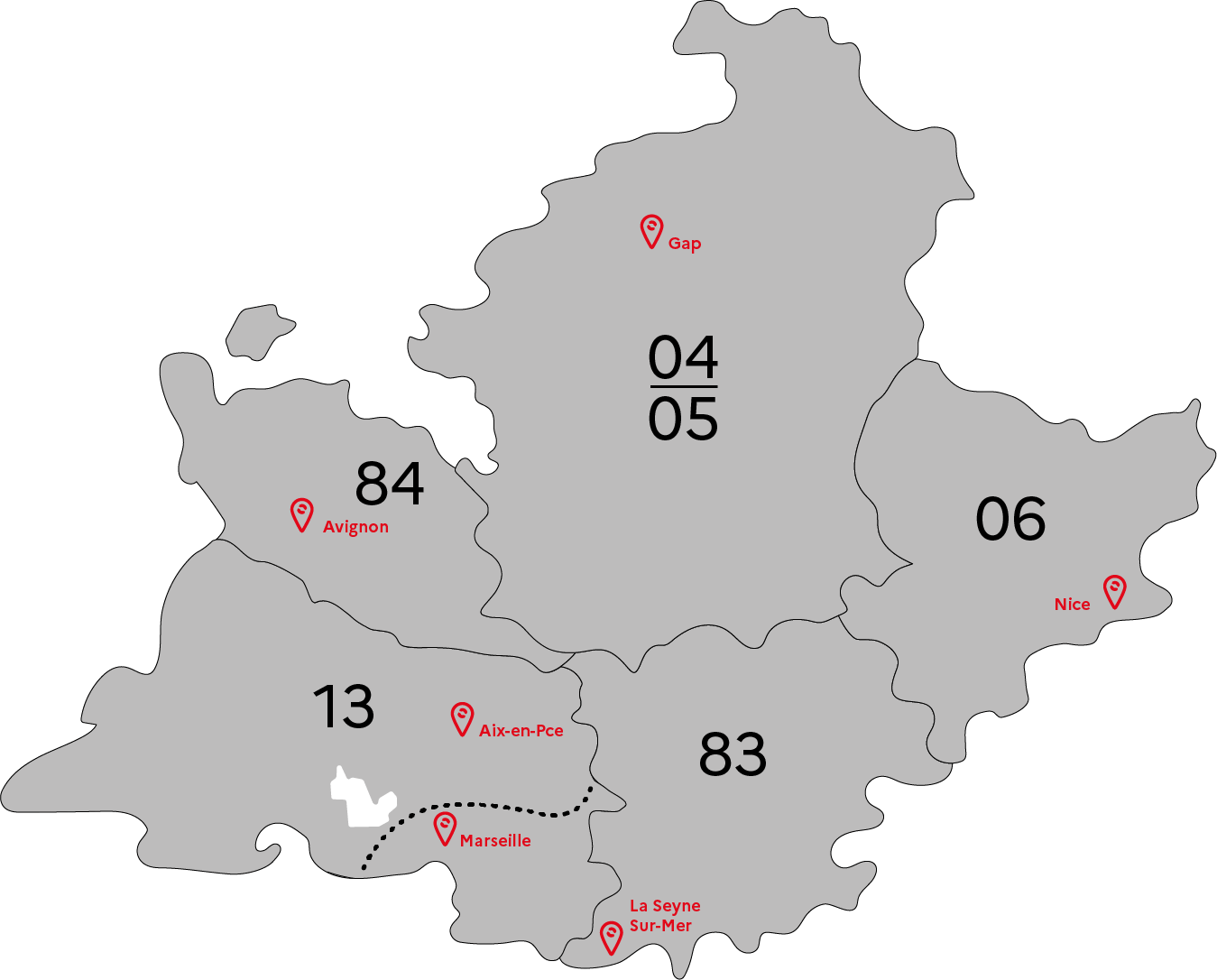

GRETA-CFA Vaucluse

GRETA-CFA Vaucluse

FORPRO-PACA

Réseau Formation Professionnelle

de l'Éducation nationale

FORPRO-PACA IS HIRING

LINKS