At the end of the course, the professional will be able to:

- calculate asset and liability valuation operations (depreciation, amortisation, provisions, inventories...)

- determine the accruals and deferrals of income and expenses for the financial year (accrued expenses, income to be received, deferred income and expenses..)

- after validation, record these operations.

- in conjunction with the chartered accountancy firm, identify the elements needed to determine the accounting result.

- work in compliance with current legislation and the procedures put in place in the company or the chartered accountancy firm.

- mobilise digital environments: integrated management software and packages

Certificate of professional competence 3 - Participating in year-end accounting operations

- Processing fixed assets and investment securities

The inventory in commercial law, accounting regulations on the recording of intangible fixed assets (start-up costs, software, goodwill...), registration of tangible fixed assets (including fixed assets in progress), registration of financial fixed assets and marketable securities, valuation rules to be applied to financial fixed assets and marketable

securities, tax rules relating to passenger vehicles (Type VP), accounting and tax depreciation, management of company vehicle tax, accounting regulations between fixed assets and expenses, accounting regulations on the registration of subsidies linked to fixed assets.

- Processing inventories, operating receivables and payables

Accounting regulations on recording : inventory transactions on the balance sheet and income statement - stocks of raw materials, finished goods and merchandise - depreciation of stocks - supplier accounts, suppliers to be paid, suppliers of fixed assets, suppliers of invoices and credit notes not yet received - customer accounts, customers with bills of exchange receivable, doubtful or disputed customers, customer invoices and credit notes to be drawn up - valuation and depreciation of customer accounts - staff accounts, remuneration due, advances and deposits on salaries, stop payments on salaries, social security and related accounts, withholding tax - government accounts, taxes payable, VAT, other taxes and duties - provisions for risks accounts - other balance sheet accounts, sundry debtors and creditors, suspense accounts, exchange differences, prepaid expenses, prepaid income.

- Treating loans and allocating income

Accounting regulations for inventory transactions relating to loans - the main legal business structures (sole proprietorship, limited liability

company, simplified joint stock company, public limited company...) - principles of profit appropriation in a sole proprietorship or similar - principles of profit appropriation in a company.

Cross-cutting skills:

- Communicating information effectively and clearly, working in a team

- Complying with rules and procedures

- Using digital environments

Find out more about this qualification (RNCP37121, exact wording of the diploma, name of the certifier, registration date of the qualification) by clicking here.

Good representation of the job.

Notions of general accounting and good knowledge of how the business works.

Ability to communicate fluently both orally and in writing, professional and/or domestic use of digital organisation and communication tools.

10 people

Positioning prior to entry into training.

Interviews, remediation with the educational referent and/or company referent during training.

For beneficiaries with disabilities: possible adaptation of training and certification methods, support by the GRETA-CFA TH referent.

Education Nationale certified teachers, Bac +3 trainers with significant experience in adult training, professional speakers.

Trainers experienced in individualising learning.

Tests at the end of training (one-off assessment)

Course evaluations (ECF)

Professional portfolio

Interview with a professional jury

Contact us to register for a meeting.

Continue on to acquire the other 2 CCP of the "Assistant Accountant" professional qualification.

Enter employment mainly in small and medium-sized companies or accounting firms.

Access for people with disabilities

Accessible to people with disabilitiesSuccess rate: 92%

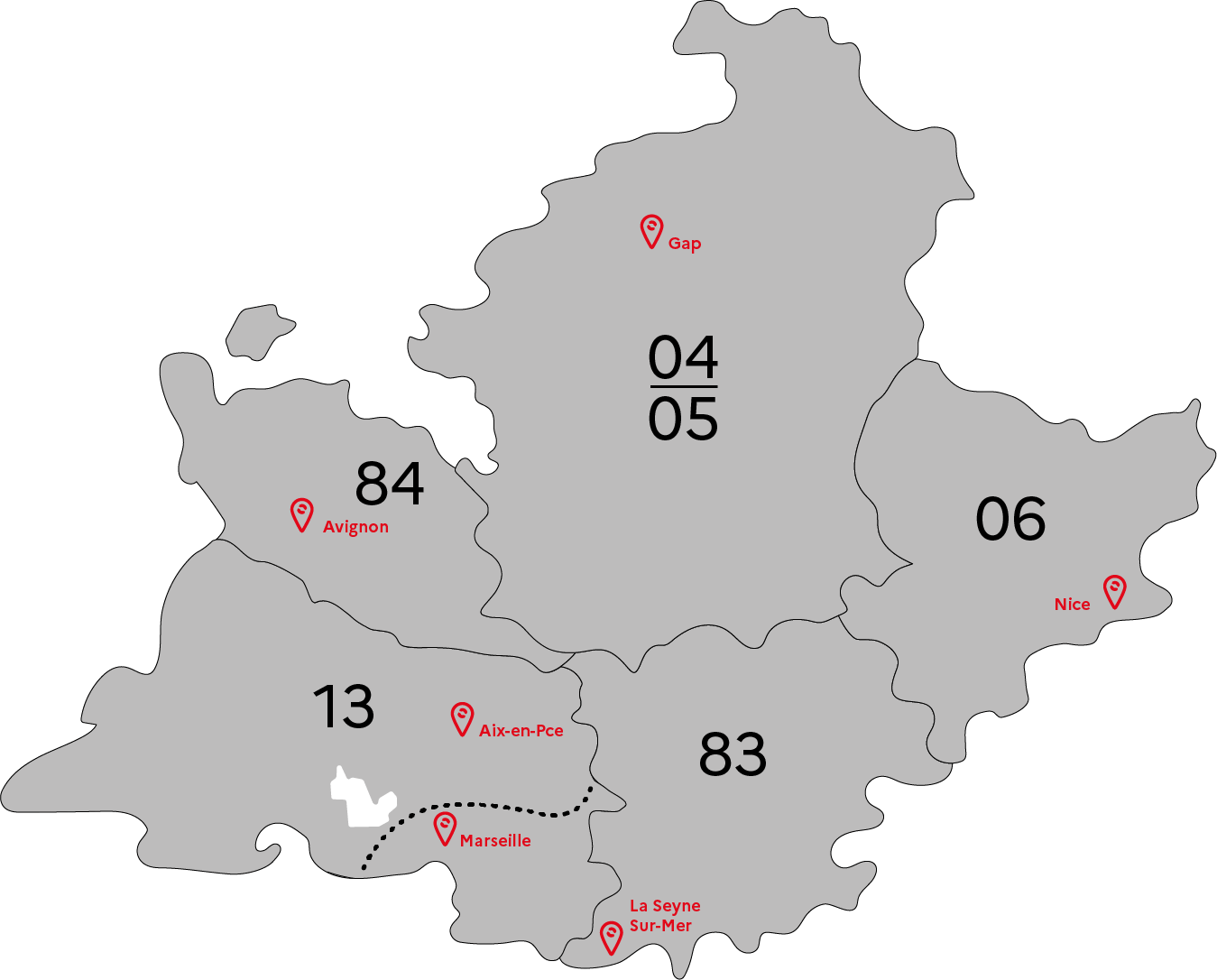

GRETA-CFA Provence

GRETA-CFA Provence

FORPRO-PACA

Réseau Formation Professionnelle

de l'Éducation nationale

FORPRO-PACA IS HIRING

LINKS